Ivane Javakhishvili Tbilisi State University

Paata Gugushvili Institute of Economics International Scientific

THE GTS (UKRAINE)[1] FOR THE EU

Annotation. The Russia-Ukraine war, the energy security of all the countries of the wider Black Sea Area (WBSA - which includes the South Caucasus) was affected. However, this conflict had the greatest impact on the main gas supplier of the European Union - the Russian JSC "Gazprom". The article discusses the process of demonopolization of the EU gas market. In particular, it is noted that the Russia-Ukraine war has disrupted global supply chains, but this provides a new opportunity for Azerbaijan. In particular, since the US and Europe have imposed sanctions on Russian oil and natural gas, it seems Azerbaijan has a chance to increase its gas exports through the Southern Gas Corridor (SGC), which passes through seven countries (including Georgia) and supplies gas to Turkey and Southeast Europe. Currently, through SGC, Azerbaijan supplies Turkey and Europe with 16 billion cubic meters (BCM) of natural gas annually.

With JSC Gazprom almost completely leaving the European energy market by the end of 2024, in order to meet the growing demand of the Southeast European gas market, Azerbaijan is developing new gas fields and is open to investments to expand the capacity of SGC, in particular, by the additional compressor stations in Georgia and Turkey. With the installation them, will be possible to double the gas flow to the southeastern part of the EU by 2027. However, in this region of Europe, from the beginning of 2024, the "Vertical Gas Corridor" project, which will be a undirect competitor of the "Southern Gas Corridor", has been launched, and it is necessary to implement relevant measures in order to harmonize two EU pipeline projects (the SGC and the Vertical Gas Corridor) and timely ensure the long-term gas supply contracts that the "Shak-Deniz" consortium has already concluded with European customers. In this article we consider possibility of using the Vertical Gas Corridor and IGB (interconnector Grece Bolgaria of the SGC) as the sources for filling the Ukrainian GTS and the UGFs (Underground Gas Storage Facilities) as an additional leveriges for the EU energy security.

Keywords: RF-Ukraine war,EU Southern Gas Corridor - EU SGC, gas pipelines, energy security, Caspian Sea, Black Sea, Gazprom, SOCAR, liquefied natural gas - LNG.

Introduction

The European Union faces a new gas challenge as the agreement for Russian gas transit through Ukraine approaches its end (late December 2024). Despite extensive reporting on the EU's progress in reducing reliance on Russian gas, fresh complications may arise when Russian pipeline gas deliveries to Europe via Ukraine cease at the year's end. The EU has reached out to Azerbaijan, seeking to fill the void left by Russian gas in Ukraine's pipeline system once the transit contract expires. This move stems from several EU members' continued dependence on Gazprom supplies, despite efforts to end reliance on Russian gas.

A key concern is how the EU and Ukraine will maintain the pipeline infrastructure without Russian gas flow. Some EU nations and businesses have proposed a plan to Azerbaijan, a Caspian Sea gas producer, to compensate for the loss of Russian gas supplies that currently reach Europe through Gazprom's pipeline network crossing Ukraine. The existing five-year deal between Russia's gas giant Gazprom and Ukraine's Naftogaz is set to lapse at the end of this year, with Ukrainian officials stating their intention to let it expire without renewal.

This situation puts several EU countries still dependent on Russian gas in a difficult position, despite the bloc's efforts to decrease its overall reliance on Moscow. Prioritizing energy security, the EU has spent over two years seeking new gas sources, heavily relying on the US and emphasizing the shift to renewable energy. Since Russia's invasion of Ukraine in February 2022, the EU has worked to stop Russian gas imports, though it hasn't imposed an outright ban. Interestingly, Russian LNG imports to Europe have actually increased since the war began.

Austria, Hungary, Slovenia, and Italy continue to import Russian gas via Ukraine. Collectively, these four nations imported about 14.4 BCM in 2023, with Austria and Slovenia accounting for roughly 6 BCM and 6.5 BCM respectively. Before the war, Russia exported approximately 150 BCM annually to Europe. These countries pay Moscow directly in rubles, while Ukraine earns a transit fee of about $1 billion from Gazprom – funds that prove crucial in its war economy.

Currently, only the Sudzha section of the Urengoy–Pomary–Uzhhorod pipeline remains operational. However, Ukraine houses significant gas pipeline infrastructure. Leaving it unused could make it vulnerable to Russian attacks or general deterioration. So far, the pipeline has managed to avoid the war damage seen in many other parts of Ukraine.

According to reports from Reuters, Politico, Bloomberg the EU is proposing that Azerbaijan supply gas to keep the pipeline operational - and to further reduce dependence on Russian gas. However, Azerbaijan is already producing gas at full capacity, and the routing infrastructure poses challenges. There's no direct link between Azerbaijan and Ukraine that could be utilized. Azeri gas would need to pass through Russia to reach Ukraine, likely resulting in financial benefits for Russia. One possibility being considered is a gas swap arrangement, where Azeri gas would be sent to Russia, and an equivalent volume from Russia would be shipped to Europe.

Hikmet Hajiyev, a senior advisor to Azeri President Ilham Aliyev, told Politiko: "Azerbaijan has been approached by the EU and the transit countries. We are discussing the issue. Currently, we are examining various options for how we can contribute to that process. I would avoid setting a timeframe, but we have taken the appeal seriously as it concerns European energy security” (EU wants Azerbaijan, 2024)

The majority of Azerbaijan's gas production comes from the offshore Shah Deniz field. This gas is exported to Georgia, Turkey, Greece, Bulgaria, Romania, Hungary, and Italy via the Southern Gas Corridor (SGC). Plans are in place to increase Azeri gas production and expand SGC capacity.

Oleksiy Chernyshov, CEO of Ukraine's Naftogaz, was quoted by Bloomberg saying: "There are two factors we should always keep in mind. First, Ukraine possesses remarkable transit and storage gas infrastructure that should be utilized. Second, Ukraine is inclined to use this infrastructure due to its numerous advantages."

While there's no disagreement with Chernyshov's statement, timing is likely to be a crucial factor in how this scenario unfolds. Some Western observers believe alternatives to Russian gas can be arranged. The US is particularly keen on utilizing a new FSRU and LNG terminal in Greece, connected by pipeline to Eastern European states. However, this could lead to the abandonment of large sections of the pipeline system in Ukraine, potentially resulting in another significant infrastructure and financial loss for Europe due to the ongoing conflict.

The impact of Russia-Ukraine war on the EU energy security

The Russia-Ukraine war had a negative impact on the export of Russian natural gas to Europe, which in previous years, together with oil, represented one of the most reliable sources of filling the budget of the Russian Federation (see chart 1).

Austria, Slovakia and Moldova are the European nations that most depend on Russian gas transit volumes across Ukraine as they imported about 5.7 Bcm, 3.2 Bcm and 2 Bcm of Russian gas respectively in 2023, think tank Rystad said July, 16. 2024.

The gas transit agreement between Ukraine and Russia is set to expire at the end of this year. Currently, nearly half of Russian pipeline gas exports to Europe still traverse Ukraine. However, Kyiv has expressed unwillingness to negotiate a new agreement.

Rystad Energy, a Norwegian consultancy, suggests that to overcome this potential disruption, Europe will need to: Reroute Russian gas through alternative pathways; Increase LNG import capacity by an additional 7.2 billion cubic meters (BCM) annually (Rystad Energy, 2024).

Despite the EU's goal to prohibit Russian gas imports by 2027, Ukraine still facilitates the transit of 13.7 BCM of Russian pipeline gas to Europe and Moldova, accounting for almost 50% of Russian supplies. While Russia is open to negotiations, Ukraine has ruled out renewing the agreement. This scenario particularly affects Slovakia, Austria, and Moldova, which imported 3.2 bcm, 5.7 bcm, and 2.0 bcm respectively in 2023. Moldova, which sourced 74% of its gas through Ukraine last year, is exploring alternatives (Rystad Energy, 2024). It has begun importing gas from Romania and reverse flow through the Trans-Balkan pipeline. If Russian gas flow through Ukraine ceases, affected countries would need to consider other options:

- The Balkan Stream;

- The Horgos entry point between Serbia and Hungary;

- LNG imports through terminals in Poland, Germany, Lithuania, and Italy.

Rystad analyst Christoph Halser notes that without a third-party transit agreement, the EU may need to source about 7.2 BCM of gas from the LNG market (Rystad Energy, 2024). The impact varies by country:

-Slovakia might require gas delivery through the Czech Republik;

-Austria would need increased imports from Germany and potentially Italy;

-Italy has multiple options to replace Russian gas;

-Hungary faces significant challenges and may rely heavily on the TurkStream pipeline.

To address these potential issues, Central and Eastern European countries are collaborating on a Vertical Gas Corridor initiative. This project aims to facilitate LNG imports from Greece and Turkey to flow northward. Additionally, Turkey and Bulgaria have agreed to increase gas entry capacity at the Strandzha 1 point, supporting Azerbaijan's goal to expand gas exports to Europe from 13 to 20 bcm by 2027.

President Ilham Aliyev of Azerbaijan suggests Ukraine should consider diplomatic approaches with Russia to resolve their conflict. "Talking is always preferable to not talking," he stated to Maryna Honcharuk, co-founder of the Ukrainian Turkic Centre, at the Shusha Global Media Forum on July 21 (Meeting of the President, 2024).

Aliyev drew parallels with Azerbaijan's past conflict with Armenia, noting that despite a lack of immediate results, there was an ongoing negotiation process. He mentioned meeting with various Armenian leaders, including those involved in war crimes against Azerbaijanis, emphasizing the need to set aside personal emotions for the sake of peace and territorial reunification. The Azerbaijani leader stressed the importance of making difficult decisions as a leader, citing his father's decision to agree to a ceasefire in 1994 when Azerbaijan lacked a regular army. He highlighted the need for patience and selflessness in leadership, stating that achieving significant goals sometimes requires challenging choices.

Regarding the impending end of Russian gas exports to Europe via Ukraine, Aliyev outlined Azerbaijan's plans to double its gas supplies to Europe by 2027, projecting 16 BCM by year-end. He mentioned discussions with Ukrainian authorities and the EU about extending the gas contract between Ukraine and Russia, expressing Azerbaijan's willingness to facilitate these talks to help countries like Austria and Slovakia secure their gas supplies (Meeting of the President, 2024).

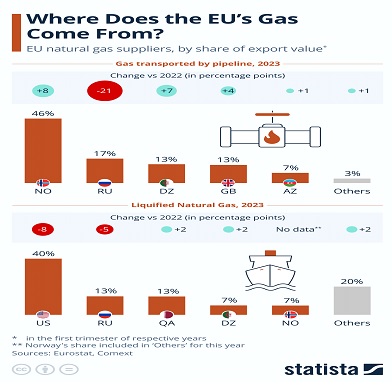

Aliyev firmly denied accusations that Azerbaijan exports Russian gas. He explained that Azerbaijan did contract 1 BCM of gas from Russia when international market prices were high and Russian gas was affordable, describing it as a purely commercial decision. He emphasized that Azerbaijan exports 25 BCM while only importing 1 BCM. The Azerbaijani President strongly refuted claims of Azerbaijan being a channel for Russian gas exports, stating, "Being accused of being a kind of channel for Russian gas exports is absolutely unfair. That was a great fake news" (Meeting of the President, 2024). The chart 1 shows how both pipeline and liquefied natural gas (LNG) import volumes to the EU from major partners have changed in 2022-2023. It is obvious that pipeline imports from Russia will make up only 17% of all imports in 2023, that means, it will drop from 150 BCM to 43 BCM in two years. The resulting shortfall was largely compensated by the growing share of other partners: imports of liquefied natural gas (LNG) from the US to Europe in 2021 increased from 18.9 BCM to 56.2 BCM in 2023, and in 2024 year all LNG - 40% of the whole import was;

chart 1

EU gas suppliers

Source: https://www.statista.com/chart31017/eu-lng-and-pipeline-natural-gas-imports-by-country/

Pipeline gas imports from Norway increased from 79.5 BCM in 2021 to 87.7 BCM in 2023; Also icreased the import of gas from African pipelines; And, imports from other partners - from 41.6 BCM in 2021 to 62 BCM in 2023, which is 3% of all pipeline gas imports to the EU.

In the second quarter of 2022, Russia's share of European natural gas imports was almost 23 percent, among other non-EU suppliers. This year, RF share was lower than in all of 2021, when it was almost 40 percent. The decrease was caused by the Western sanctions against Russia, due to the invasion of Ukraine and by JSC "Gazprom" reducing the supply of gas to Europe. Germany was the main export destination for natural gas from Russia, and in 2021 it received 23.7 percent of the total volume of gas exports from the RF via pipelines. Turkey was next, receiving 13 percent of total Russian natural gas exports in 2021 (Extra-EU, 2024).

But under the conditions of war, JSC Gazprom, the Russian energy giant, whose majority stake is owned by the Russian state, ended 2023 with a loss of almost $7 billion for the first time in a quarter of a century. According to the data of the European Commission, the share of JSC "Gazprom" in the pipeline gas import of the European Union decreased from 40% in 2021 to 8% in 2023 (International. The news 2024). In 2023, the EU was already receiving the majority of its liquefied natural gas (LNG) imports from the US. If in 2021 the USA delivered 19 BCM of liquefied gas to the EU member states, in 2023 this figure reach 56.2 BCM. And in 2023 Qatar also increased the export of liquefied gas to Europe – up to 15.5 BCM. Currently, the largest supplier of pipeline gas in the European Union is Norway, which has increased gas sales from 79.5 BCN to 87.8 BCM in the last two years (Tim Wallace. The Telegraph 2024). By country, the main gas suppliers in the EU in 2023 were Norway and the United States. Norway provided almost 30% of all gas imports to Europe. Additional suppliers include North African countries, the UK and Qatar. A list showing market shares and values (in BCM) for different EU gas suppliers in 2023 looks like this:

Gas market share for the EU’s importers

|

Country/share |

|

|

|

Norway |

30,3% |

87,8 BCM |

|

USA |

19,4% |

56,2 BCM |

|

North Africa |

14,1% |

41 BCM |

|

Russia (pipeline) |

8,7% |

25,1 BCM |

|

Russia (liquid LNG) |

6.1% |

17,8 BCM |

|

Great Britain |

5,7% |

16,6 BCM |

|

Qatar |

5,3% |

15,5 BCM |

|

Other |

10,3% |

29,9 BCM |

Source: EC, ENTSO-G and Refinitiv; https://www.consilium.europa.eu/en/infographics/eu-gas-supply/.

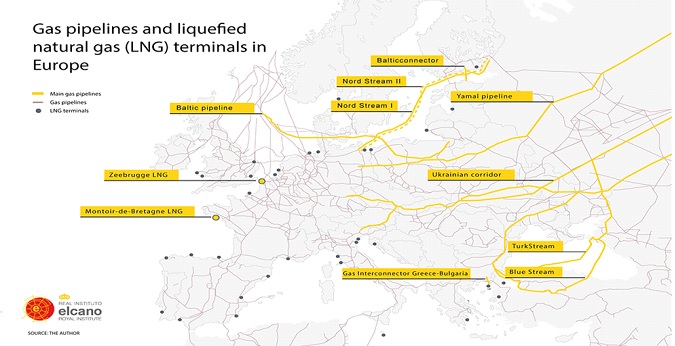

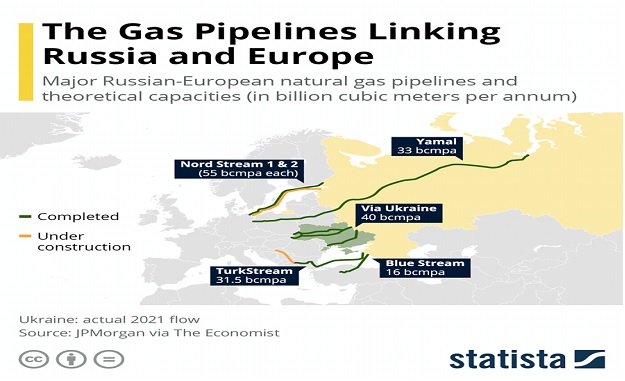

Along with the closure of Russian pipelines, the import of liquefied natural gas (LNG) by tankers to the European Union is increasing. In 2023, the European Union imported more than 120 BCM of LNG. In 2023, the United States was the largest supplier of LNG to the EU, accounting for nearly 50% of total LNG imports. In 2023, compared to 2021, imports from the USA increased 3 times. The largest importers of LNG are in the European Union (see charts 2, 3 where LNG regasification terminals are shown): France, Spain, Netherlands, Belgium, Italy. Chart 2 shows the geography of liquefied natural gas (LNG) regasification terminals of the EU coasts, while Chart 3 shows the share of pre-war Russian pipeline gas in EU imports, falling from 40% in 2021 to around 8% in 2023. Already at the beginning of 2024, the share of Russian pipeline gas and LNG together was less than 15% of the total EU gas imports. The decrease in Russian gas consumption was made possible thanks to the increase in American LNG imports and the decrease in gas consumption in the EU.

chart 2

Geography of Liquefied Natural Gas (LNG) Regasification Terminals Offshore in the EU

Source: https://www.realinstitutoelcano.org/en/policy-paper/the-future-of-russian-gas-in-the-eu/

chart 3

The share of Russian pipeline gas in EU imports before the Russian Federation-Ukraine war

Source: JP Morgan via the Economist https://www.statista.com/chart/26769/russian-european-gas-pipelines-map/.

In this article, we argue the hypothesis that as a result of the Russia-Ukraine war, the gas market of South-Eastern Europe has been demonopolized. In particular, in 2022-2023, the growing demand resulting from the reduction of the shareof the horizontal concentration of the Russian "Gazprom" in this market may be met by the "Vertical Gas Corridor" of liquefied natural gas (LNG) and Southern Gas Corridor’s (SGC) Komotini-Stara Zagora Interkonnector. Its creation is intensively underway from the beginning of 2024 in the same gas market - South-Eastern Europe. This will increase the importance of the Ukrainian GTS (Gas Transportation Sistem Operator) and Undergraund Gas Facilities (UGF) of Ukraine. There are two new options of demonopolizationof the EU gas market: 1) Black Sea LNG transit and 2) Vertical Gas Corridor.

Opption 1: Black Sea route of the LNG transit

Until now, the widespread use of green natural gas worldwide has been limited by problems related to transit pipeline control, access to pipelines, their routes, and the availability of sufficient quantities of cheap energy such as coal and oil.

Firewood, the first historical and logical type of fuel, was available almost everywhere; The next fuel accordingly, coal can generally be found in most countries of Europe and America. Later, reserves of another type of energy resource - oil - were discovered in dozens of countries. But gas is found only in a few places on the planet. Among them, Russia, USA, Iran, Turkmenistan have the largest intelligence stocks... According to economic theory, a monopoly occurs when individuals or businesses acquire enough power ("market power") to control the supply of certain goods or services. In this sense, the concentration of oil production in the hands of about 20 states led to the creation of the simplest form of monopoly - OPEC, or the oil cartel.

In the case of gas, the concentration of production and special transport infrastructure - gas pipelines - is even higher globally: they are concentrated in the hands of only a few countries, which has led to an even higher level of monopolization. This was something completely new for the global energy supply and demand mechanism. Gas remains the second most important energy source in the EU, after oil-based energy. However, to stay within the 1.5 degrees’ Celsius target set by the Paris Agreement, the EU is actively looking for ways to accelerate the transition to renewable energy sources, including the European Green Deal and the European Commission's Communication on Deal 55, including the RePowerEU plan. Under this sustainable scenario, European gas demand would decrease by 617 BCM in 2028, and 380 BCM in 2040 (Extra-EU, 2024).

Before the war, Russia was the world's leading exporter of natural gas, and its volume far exceeded that of the United States, Qatar, and Norway. In 2021, the country exported 201.7 BCM of gas through pipelines and 39.6 BCM in the form of liquefied natural gas (LNG). Exports grew steadily between 2014 and 2019, with a four percent decline in volume in 2020 as a result of lower fuel demand and slower economic activity due to the coronavirus (COVID-19) pandemic.

Russian gas exports to Europe were severely affected by the invasion of Ukraine that began in February 2022. In response to the war, European countries tried to reduce their dependence on Russian gas. From January 1 to July 15, 2022, the Russian company Gazprom exported 33 percent less gas to far-off foreign markets, compared to the same period of 2021. In addition, Germany announced a suspension of the certification process for Nord Stream 2, and Russia cut off gas supplies through Nord Stream 1 in September 2022, before leaks were discovered on both pipelines. Gas exports from Russia to India and China also did not increase in monetary terms in July and August 2022 compared to February and March 2022.

Before the war, the five largest consumers of Russian pipeline gas were: Germany, Italy, Belarus, Turkey and the Netherlands. Germany stopped direct imports of Russian gas in the summer of 2022, months after a full-scale invasion of Ukraine, but significant amounts of Russian gas continue to be imported into the country via supplies from its neighbors; Germany continues to import Russian natural gas via Belgium and the Netherlands, albeit in the form of LNG, the Brussels report said (Dependence on Russian gas, 2024)

On November 21, 2022, Mr. Levan Davitashvili, Vice Prime Minister and Minister of Economy of Georgia, announced during a briefing that the Georgian government is actively developing a project to supply gas from Azerbaijan's Caspian Sea shore to Europe via Georgia. According to Mr. Davitashvili, this initiative, which also involves Azerbaijan, Romania, and Hungary (AGRI LNG), commenced in 2015. The project envisions a process whereby "…gas will be liquefied on Georgian territory, then re-gasified in Romania." He acknowledged that while the project had previously stalled, it has gained renewed relevance in light of Europe's current emphasis on diversifying energy supplies (L. Davitashvili, 2022).

Mr. Davitashvili further elaborated that an evaluation of the project and the requisite infrastructure in Georgia and Azerbaijan is underway. This project could use Ukrainian GTS and UGFs after regasification of Azeri LNG on Black Sea western shore. He cautioned that the project implementation would be a gradual process, requiring a comprehensive assessment, followed by the formulation of a detailed action plan, and culminating in a step-by-step execution, including the attraction of investments (L. Davitashvili, 2022).

As global energy dynamics continue to evolve, projects like AGRI underscore the importance of international cooperation in addressing energy security concerns. The successful implementation of this initiative could serve as a model for future energy projects, demonstrating the potential for collaborative efforts to create mutually beneficial solutions in the face of complex global challenges. But AGRI is expencive project: it nees de- and re-gasification terminals, special LNG tanker fleet, additional gas pipeline from South Caucasus Gas Pipeline (SCP) to the Black Sea Kulevi Terminal (BST Ltd), underground gas storage facilities (UGS) on Georgia Black Sea shore, etc. Cheaper usage of existing infrastructure.

Opption 2: Vertikal Gas Corridor (using existing infrastructure).

Before the war, Russia earned about $11 billion a year from exporting oil and gas through Ukraine. Meanwhile, Ukraine received only 1 billion dollars from transit fees. This data belongs to Serhiy Makogon, director of the "Gas Transportation System" operator (GTS) of Ukraine, and is quoted by UBN (If the transit of Russian gas, 2024).

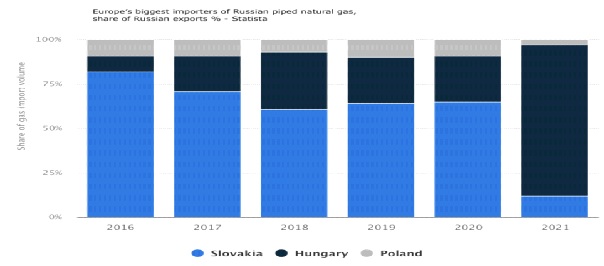

chart 4

Main importers of the RF piped gas in the Central EU by the end of 2021

Sourse: Europe’s biggest importers of Russian piped natural gas, share of Russien exports (%) - Statista https://www.statista.com/statistics/1201743/russian-gas-dependence-in-europe-by-country/

In 2019, Russia was the only source of natural gas supply for North Macedonia, Moldova and Bosnia-Herzegovina. Another European country heavily dependent on Russian gas was Latvia, where it accounted for 90 percent of the total in 2021. In Estonia, the share of natural gas received from Russia was significantly lower, totaling 12 percent. In 2021, Russia accounted for more than 39 percent of gas imports from outside the EU (chart 4). How much natural gas does Russia export?

By this report, Hungary is particularly dependent on imports: 75% of its gas comes from Russia, 60% of its oil. By the end of 2024, Hungary remains the largest consumer of Russian gas in Europe. Similarly, Slovakia is dependent on Russian gas imports. From the summer of 2022, the share of natural gas imports from Russia fell from 85% to around 50% in 2023, which "...remains nevertheless significant" according to the EU report. The reduction was achieved by the construction of a new gas pipeline from the Polish-Slovakian border at the end of 2022, which is connected to gas supplied from Norwegian gas fields. With this, Slovakia receives 5.7 BCM of gas per year and it is also connected to LNG terminals in the Baltic Sea (Quarterly Report, 2023).

On August 6, 2024, the Armed Forces of Ukraine (AFU), after invading Kursk Oblast, captured the Sudzha gas metering station and now it is under its control. About 42 million cubic meters of gas per day is transit to Ukraine through Suja. Than it go to Hungary, Slovakia and Austria. Also, part of this gas is taken by Italy and Moldova. In total, Ukraine have sent 13 BCM of gas to Europe in 2023 - less than half of what was sent before the war.

The transit capacity of the Suja Energy Hub is approximately $6 billion in oil and $5 billion in gas. However, due to the ongoing hostilities in the Kursk region, there are risks of gas transit, which may lead to supply interruptions (If the transit of Russian gas, 2024).

Mr. S. Makogon notes that there are two main risks in this transit business: military risks and commercial risks. The territory of Suja is networked with gas pipelines, and from the Russian side, the risk of damage to the infrastructure by heavy artillery or aerial bombs is "very high" (If the transit of Russian gas, 2024).

Commercial risks include loss of proper gas accounting. "...transportation of gas through Ukraine without proper documentation shall be considered contraband", according to S. Makogon (If the transit of Russian gas, 2024).

Mr. S. Makogon said there are no significant risks to Ukraine or Europe if transit flows through Suja are stopped. Since 2015, Ukraine has not imported gas from Russia and is preparing to work without transit from 2019. In addition, the EU receives only 4% of its gas imports through Ukraine, and today it is down about 35% from pre-war levels. A large part of Ukraine's supply has been replaced by LNG imports to Europe (Ukraine can import, 2022). Currently, neither side of the conflict plans to close gas transit businesses amid the fighting in Kursk Oblast (Ukraine and Russia, 2024).

Nevertheless, the fear of closing the Urengoy-Pomary-Uzhgorod gas pipeline forced the Europeans to increase gas prices to $450 per 1,000 cubic meters, which usually does not happen during low summer demand. At the same time, European gas traders avoid storing gas in the largest Ukrainian gas storage facilities in Europe. Ukraine's national gas company, Naftogaz, said it was operating normally, but this summer, European traders signed only small contracts to use Ukrainian gas storage facilities, citing Russian air and artillery attacks.

According to experts, in June and July 2024, European companies stored 15.4 million and 51.9 million cubic meters of gas in Ukrainian gas storages, instead of 102.7 million and 586.6 million cubic meters in June-July 2023 (Ukraine and Russia, 2024). This suggests that, as in the past, gas traders have been storing gas for the summer, predicting that prices will rise once the heating season begins.

However, in our opinion, the reason for keeping a small amount of gas in the gas storage is the high gas prices on the European spot market. Therefore, we consider it necessary to encourage the supply of gas to the underground storages of Ukraine via the GTS.

A potential solution is a gas swap with Azerbaijan, which should replace imported Russian gas. As many Ukrainian gas storages as possible should be filled with Azerbaijani gas. It should be noted that the President of the Russian Federation Vladimir Putin was in Baku on August 19, 2024 and met with his colleague the President of Azerbaijan Ilham Aliyev, according to experts to discuss these issues. A possible deal means Russia has a commercial interest in keeping Ukraine's pipeline network intact and is less willing to damage pipeline infrastructure and gas storage facilities, experts say (Ukraine and Russia, 2024). Central Europe is still highly dependent on Russian gas. In 2023, the EU Central and Southeastern regions were still the largest buyers of Russian gas - 41% of Russia's pipeline gas exports came from this region, followed by Turkey (29%) and China (26%). Brussels sanctions have not been imposed on the import of gas from the Russian pipelines to the European Union, it was stopped by Russia itself in 2023. Negotiations have recently started with Slovakia on the replacement of Russian gas imports by Azerbaijani ones. Slovak Prime Minister Robert Fico traveled to Baku in May 2024 to sign a wide-ranging memorandum with Azerbaijan covering cooperation on gas supplies. Mr. R. Fizo has repeatedly said that his country intends to continue importing Russian gas, even through Ukraine (President of Azerbaijan, 2024 Geo.).

Questions have been raised that Azerbaijani gas will be Russian gas in disguise. In 2023, Azerbaijan supplied about 13 BCM of pipeline gas to Europe, but the supply is expected to increase by 20 BCM by 2027, and via the Interconnector Grece Bolgaria – IGB by 3 BCM (See chart 5).

chart 5

IGB of the EU’s SGC

Source: https://blacksea-caspia.eu/en/interconnector-greece-provides-access-natural-gas-number-municipalities

Currently, however, Baku does not have the production capacity to meet all of this demand and is relying on growth projections from new deposits and intensification of existing assets. However, it also has the option of bringing Russian gas into Europe through the "back door" – via the SGC, ostensibly for domestic supply, which in turn would free up more Azerbaijani gas for export, or simply have Russian gas for re-export. How can the supply of Russian gas to the South Caucasus be restored?

The Russian energy giant Gazprom announced at the end of November 2022 that it will supply Azerbaijan with about 1 BCM of natural gas from December 2022 to March 2023. This decision was made in the background of the delay in the establishment of a gas center in Turkey and to avoid sanctions. The contract was signed with the State Energy Company of Azerbaijan SOCAR.

Historically, "Gazprom" supplied gas to Azerbaijan in 2000-2006. Subsequently, Azerbaijan increased its gas production at the Shah Deniz field through BP, allowing it to meet both domestic demand and export to Georgia and Turkey. In 2017-2018, Azerbaijan started buying Russian gas again, but it stopped in 2019, when gas from the second phase of "Shah-Deniz" was sent to Turkey.

Azerbaijan prioritizes gas exports to maximize revenues. The new agreement with "Gazprom" coincided with the expected peak demand in the winter of 2023. However, the resumption of Russian gas imports raises questions, as Azerbaijan recently committed to increasing gas supplies to Europe. SOCAR noted that they have a long history of cooperation with Gazprom, and both companies are trying to optimize their infrastructure by exchanging gas flows.

Starting from 2020, Azerbaijan is supplying by 10 BCM of natural gas to Europe annually through the EU's "Southern Gas Corridor" (SGC). According to the agreement signed between Baku and Brussels in the summer of 2022, Azerbaijan undertook to increase its exports to 12 BCM. Both sides positively assessed this move as a deepening of energy cooperation and a success in diversifying the EU's gas supply.

However, in reality, Azerbaijan was able to supply 18 BCM of gas to Europe. From the beginning of 2024, the country is conducting negotiations on gas supply with several European states. President Aliyev said that SGC is already working at full capacity and for additional exports, it needs to be expanded and new pumping stations installed. He noted that Azerbaijani gas is already supplied to Bulgaria and Romania, and Serbia may soon join this network.

According to “Eurasianet”, a source related to the "Shah-Deniz" consortium says that additional export deals, exceeding the already agreed 10 BCM, have not been agreed with the operating consortium (N. Garakanidze, Z. Garakanidze. 2024 Geo.).

In addition, without the addition of Russian gas, Azerbaijan could not increase its gas extraction from 10 to 18 BCM in one year for objective reasons. In particular:

- Azerbaijan's energy company "Sokar" develops most of the gas fields, including "Absheron", "Karabakh", "Shah-Deniz 3", "Umid" and "Babek" in cooperation with Western companies. However, recently, due to environmental considerations, these companies (BP, Total, Equinor, Statoil, etc.) have almost halved their investments in mineral extraction and paid more attention to alternative energy projects;

- For the same reason, the traditional financiers of the "Southern Gas Corridor" (EIB, EBRD, etc.) reduced lending for fossil fuel extraction;

- Caspian new gas fields are in difficult geological conditions. For example, one of the promising fields is located under the "Azeri-Chiraghi-Guneshli" oil field, which makes it difficult to exploit it until the oil is completely exhausted. There are similar difficulties at the "Umid", "Babek", "Zafar" and "Mashal" deposits.

As studies show, there are doubts as to whether Azerbaijan has enough gas to continue exporting large quantities in the long term. What gas field projects are currently underway and can they be counted on for further Azerbaijani exports to Europe? What gas production can be expected in the future?

In addition to the above, there are a number of fields in the country that could contribute to Azerbaijan's gas balance this decade, and several new projects are currently under consideration or in development. In particular, the "Absheron" project seems to be the most promising and developed project. The Absheron gas field is an offshore natural gas field in the Caspian Sea, located 25 kilometers northeast of the Shahdeniz field. It is developed by the Joint Operating Company of Absheron Petroleum (JOCAP), a joint project of SOCAR (50%) and the French TOTAL (50%). Mining will begin soon. However, it will start producing only 1.5 BCM per year, most of which will be allocated to meet Azerbaijan's growing gas demand. Therefore, massive long-term investments need to be made to consider importing significant volumes of increased Azerbaijani gas through the SGC, which will take a long time. Indeed, there are plans to raise the production of this field to the second stage, increasing production to 5 BCM per year. But this requires significant investment and the final investment decision has not yet been made.

Other areas are at various stages of research and development and offer quite promising discoveries. For example, the "Shafag-Asiman" field is located in the Caspian Sea, 125 kilometers southeast of Baku. It is explored under a BP-SOCAR production sharing agreement, with an equal share. Drilling of a well completed in 2021 encountered gas reserves and data analysis of field capacities is still ongoing (SOCAR-Equinor exploration, 2021).

Another promising project is the deposits explored by the SOCAR-Equinor deal (Equinor is a Norwegian company). The deposits analyzed within the framework of this consortium are the "Karabakh" and "Dan Ulduzu-Ashraf-Aifar" deposits (SOCAR-Equinor exploration, 2021). "Ashraf-dan Ulduzu-Aifari" area is located 50 km east of Baku and 14 km east of the coastline of the Absheron peninsula. Preliminary results of the interpretation show that the oil and gas reserves in this prospective field are higher than previously expected (La sécurité énergétique, 2022).

Ultimately, as the above data proves, Azerbaijan's contribution to meeting Europe's gas demand may be significant, but insufficient considering the EU's real needs. This marks Azerbaijan as a second-tier partner in the EU's diversification strategy. According to a European Parliament report published in March 2020, Azerbaijan could supply only 3% of the EU's global energy imports (La sécurité énergétique, 2022).

However, as mentioned earlier, Azerbaijan's contribution could be important for Southeast Europe as leverage for these countries to negotiate better deals with other source countries, namely Russia. Prospects for building new connectors with Southern and Eastern European countries, especially North Macedonia, Serbia and Hungary, still seem to depend on the prospect of SCP expansion to make these investments make economic sense. Indeed, there are two points to consider. First, from a political point of view, it is more advantageous to have multiple pipelines. Secondly, from an economic point of view, it is important that pipelines are full and not numerous.

In addition, at a meeting between the European Commission and President Aliyev in July 2022, President Ursula von der Leyen highlighted Azerbaijan's potential for renewable energy in the form of offshore wind and, therefore, green hydrogen production. Indeed, Azerbaijan has renewable energy potential and plans to increase its share.

All of the above raises the question: is Russian gas being secretly sold in the name of Azerbaijani gas in order to excessively fulfill the terms of the July 2022 EU-Azerbaijan memorandum?

Azerbaijan's resumption of Russian gas imports can be interpreted in two ways: on the one hand, it may indicate Baku's concern about the growth of domestic demand. On the other hand, it could be a strategic move - to use cheap Russian gas for domestic consumption to free up more Caspian gas for export to Europe. Although Azerbaijan has the right to buy Russian gas and is not bound by the sanctions against Gazprom, this deal is effectively a "swap" supply and somewhat contradicts the spirit of the Baku-Brussels agreement of July 2022. It also shows Europe's difficulties in replacing Russian gas and Moscow's attempt to use the EU's "Southern Gas Corridor" (SGC) for its own purposes.

Gazprom will likely try to pipe Russian gas into SGC's pipes through the Soviet-era Azerbaijan-Russia pipeline and then sell it to Europe as Azerbaijani. This strategy is due to the fact that "Gazprom" does not have enough funds to build a Russian gas hub in Turkey, or to expand the second line of "Turkish Stream", which can be seen from the company's 2023-2024 investment programs (Инвестпрограмма, 2024).

Therefore, EUROPE URGENTLY NEEDS to fill Ukrainian underground gas storage facilities (UGF) using a Vertical Gas Corridor. What does it mean?

In January 2024, Ukraine, Moldova and Slovakia joined the "Vertical Gas Corridor" project of the European Union. This project, initiated by Greece, Bulgaria, Romania and Hungary, aims to strengthen the regional gas supply security of 7 South-East European countries and reduce dependence on receiving Russian gas. All countries have signed a memorandum of cooperation, which means that significant progress has been made in the implementation of the "corridor" plans (S&P GlobalRatingsSE European gas transmission 2024).

The "corridor" will follow the existing route of the "Trans-Balkan pipeline" built by the Soviet Union in the 80s of the last century, which was already used to transport Russian gas in the southeast direction - to Greece. It also crosses the SGC’s TAP (TransAdriatic Pipeline). However, the "Vertical Corridor" will supply gas to the region from the opposite direction - from the south, allowing more countries to receive regasified liquefied natural gas (LNG) brought by gas tankers from the Greek coast.

chart 6

EU’s Vertical Gas Corridor

Source: https://tsoua.com/wp-content/uploads/2024/01/Map-1-EN-site.jpg

Instead of building a completely new pipeline, it is planned to first create a connecting system of the existing national gas networks (chart 6). "Revithoussa LNG" terminal with an annual capacity of 7 BCM is already operating in Greece, and in a few months it is planned to open a second similar terminal with an annual capacity of 5 BCM in Alexandropoulos. The Greek government is also considering the creation of additional regasification capacities there. The country also has access to pipeline gas from Azerbaijan to Greece via the EU's Southern Gas Corridor (SGC) "Trans-Adriatic Gas Pipeline" (TAP).

Chart 6 shows that the mentioned "Vertical Corridor" will connect this region with the future Romanian offshore gas supply from the Black Sea. In particular, with the "Neptune Deep Field" - the project on the bottom of the Black Sea, which will start operating in 2027 and will produce 8 BCM of gas annually.

In addition, the "Vertical Gas Corridor" provides the South-Eastern Europe region with access to Ukraine's huge underground gas facilities (UGF), the combined volume of which is more than 31 BCM. This provides EU security against gas supply shocks, especially for countries in Southeast Europe that do not have their own gas storage capacity.

Moreover, chart 6 shows that countries such as Hungary, Moldova and Slovakia, which are still heavily dependent on Russian gas, will have the opportunity to switch gas suppliers if necessary. Moldova currently covers almost all of its gas demand with Russian gas, but already in April 2023, the state energy company "Energocom" signed a gas purchase agreement with Greece's DEPA. So far, however, neither the Slovak nor Hungarian governments have expressed a desire to sever energy ties with Moscow, despite facing EU pressure over their dependence on Russian gas.

Conclusion

The Russia-Ukraine war highlighted the geo-economic importance of the Ukrainian GTS in terms of demonopolization of the EU gas market. In particular:

- The hypothesis expressed in the introduction of the article, was confirmed: as a result of the Russia-Ukraine war, the gas market of Southeast Europe was demonopolized. Since 2023, JSC Gazprom's "Trans-Balkan Pipeline", which has been stopped, will be replaced by the "Vertical Gas Corridor" in the mentioned regional gas market from the beginning of 2025, which will become a direct supplier, along with of the "Southern Gas Corridor" (SGC), of the southeastern EU;

- In the conditions of the Russia-Ukraine war, the role of the "Southern Gas Corridor" as an alternative to JSC "Gazprom" monopoly pipelines, and therefore, the transit importance of Wider Black Sea Area (WBSA) for the energy security of the European Union, will increase even more;

- "Vertical Gas Corridor" along the ICB of the SGC will partially open access to the ability of the Ukrainian GTS and UGFs to export energy resources to the world market through WBSA and will have a positive impact on the transit capabilities and stability of the Southeastern EU;

- In the conditions of intensified competition in the gas market of Southeastern Europe, it is necessary to design the supply of liquefied natural gas from Azerbaijan to Romania, special attention should be paid to SOCAR's BST Ltd. in Kulevi port (Georgia) on the possibility of building a degasification LNG terminal;

Thus, the sooner the “Vertical Gas Corridor” is built and the Black Sea liquefied gas tanker transportation project (AGRI LNG) is implemented, the sooner the GTS will be filled from the south and the energy security and demonopolization of the European Union gas market will be ensured.

References

- Ukraine to Fulfill Its Oil Transit Contracts, Naftogaz CEO Says. By Olesia Safronova. August 30, 2024 at 4:39 PM GMT+4. https://www.bloomberg.com/news/ articles/2024-08-30/ukraine-s- naftogaz-to-continue-contractual-oil-obligations?embedded-checkout=true

- Meeting of the President Ilham Aliyev with the participants of the 2nd Shusha Global Media Forum. 20 July 2024, 16:00. https://president.az/en/articles/view/66533

- EU wants Azerbaijan to fuel Russian gas pipeline in Ukraine. By Gabriel Gavin, Federica Di Sario and Victor Jack. June 13, 2024 12:13 pm CET; https://www.politico.eu/article/eu-asks-azerbaijan-replace-russian-gas-transit-deal-ukraine-expiring/

- Rystad Energy - Data Insights. Oil and gas industry outlook. https://www.rystadenergy.com/?gad_source=1&gclid=Cj0KCQjw_sq2BhCUARIsAIVqmQvcx5BSBqjJLWHimJ6TtSOyvKZ_ZcIBZ5leSOOKSXsZPb7D-8mqGZsaAmpZEALw_wcB

- Extra-EU natural gas import share from Russia 2010-2022 https://www.statista.com/statistics/1021735/share-russian-gas-imports-eu

- Gazprom plunges to worst loss in decades. International The news, By News Desk, May 03, 2024. https://www.thenews.com.pk/print/1184714-gazprom-plunges-to-worst-loss-in-decades;

- Tim Wallace. How Putin’s gas empire crumbled. Gazprom once kept the lights on in Europe – now, it faces humiliating losses. https://www.telegraph.co.uk/business/2024/05/03/russia-putin-gas-empire-crumbled-europe-;

- Dependence on Russian gas in Europe 2021, by country Published by Statista Research Department, May 22, 2024. https://www.statista.com/statistics/1201743/russian-gas-dependence-in-europe-by-country/

- Ukraine can import gas from foreign LNG terminals. Monday, May 16, 2022. https://ubn.news/ukraine-can-import-gas-from-foreign-lng-terminals/

- If the transit of Russian gas to the EU through Sudzha stops, who will lose more? Tuesday, August 20, 2024. https://ubn.news/if-the-transit-of-russian-gas-to-the-eu-through-sudzha-stops-who-will-lose-more/

- Quarterly Report on European Gas Markets. chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://energy.ec.europa.eu/system/files/2023-01/Quarterly%20report%20on%20European%20gas%20markets%20Q3_FINAL.pdf

- Ukraine and Russia Plan to keep gas Flowing Amid Fighting. August 12, 2024. https://www.bloomberg.com/news/articles/2024-08-12/ukraine-and-russia-plan-to-keep-gas-flowing-as-fighting-rages?embedded-checkout=true

- Presidents of Azerbaijan and Slovakia… (Geo.) აზერბაიჯანის პრეზიდენტმა და სლოვაკეთის პრემიერ-მინისტრმა სტრატეგიული პარტნიორობის შესახებ ერთობლივ დეკლარაციას მოაწერეს ხელი. 20:02, 07.05.2024. https://1tv.ge/news/azerbaijanis-prezidentma-da-slovaketis-premier-ministrma-strategiuli-partniorobis-shesakheb-ertobliv-deklaracias-moaweres-kheli/

- Zurab Garakanidze, Nata Garakanidze. INFLUENCE OF THE MIDDLE EAST TENSION ON THE EU’S SOUTHERN GAS CORRIDOR (co-author). THE Caucasus & Globalization. Journal of Social, Political and Economic Studies. Volume 7, Issue 1-2 2013; p. 74-81. http://www.ca-c.org/c-g/2013/journal_eng/c-g-1-2/07.shtml

- Матвей Катков. Чем и когда ЕС хочет заменить газ из России. 8 Июня, 2022. https://www.vedomosti.ru/business/articles/2022/06/08/925631-chem-es-zamenit-gaz

- According to the definition of the Georgian Competition Agency, "...in the case of horizontal concentration, its participating parties operate in the same product and geographic market and, therefore, are direct competitors.” Georgian Competition and Consumer Protection Agency. Guidelines for the Assessment of Horizontal Concentration"https://gcca.gov.ge/uploads_script/legislation/tmp/php02x91B.pdf(Geo)

- «Газпром» стал убыточным всего через два года после ухода с европейского рынка — впервые в XXI веке. Почему не помог Китай? И на чем теперь зарабатывать компании?16:05, 7 мая 2024 Источник: Meduza. https://meduza.io/feature/2024/05/07/gazprom-stal-ubytochnym-vsego-cherez-dva-goda-posle-uhoda-s-evropeyskogo-rynka-vpervye-v-xxi-veke-pochemu-ne-pomog-kitay-i-na-chem-teper-zarabatyvat-kompanii

- Monthly Oil Market Report. https://www.opec.org/opec_web/en/publications/338.htm

- SE European gas transmission initiative set for expansion under new MOU. https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/natural-gas/011924-se-european-gas-transmission-initiative-set-for-expansion-under-new-mou

- Levan Davitashvili. I hope… (Geo.) ლევან დავითაშვილი: იმედი გვაქვს, რომ მიმდინარე წელს უკვე დაიწყება ნავთობის გატარება ბაქო-სუფსის მილსადენით. Europe Time, 2024-03-12. https://europetime.eu/en/article/55346-levan-davitashvili:-imedi-gvaqvs,-rom-mimdinare-shels-ukve-daishkeba-navtobis-gatareba-baqo-sufsis-milsadenit

- N. Garakanidze, Z. Garakanidze. Geoekonomic challengies… (Geo.) Business Engineering. GTU. N1-2; ნატა გარაყანიძე, ზურაბ გარაყანიძე. ევროკავშირისა და საქართველოს ენერგეტიკული უსაფრთხოების გეოეკონომიკური გამოწვევები. ბიზნეს-ინჟინერინგი, N1-2, 2024. სტუ, გვ. 20-31. http://www bpengi.com/home/2024/number-01-02;

- SOCAR, Equinor consider accelerated exploration, development scenarios in Azerbaijan March 18, 2021. https://www.ogj.com/exploration-development/article/14199601/socar-equinor-consider-accelerated-exploration-development-scenarios-in-azerbaijan

- La sécurité énergétique, 2022 https://www.imf.org/fr/Publications/fandd/issues/2022/12/cafe-econ-in-search-of-energy-security

- Инвестпрограмма «Газпрома» на 2024 года утверждена в размере 1,57 трлн рублей. 20 декабря 2023. https://portnews.ru/news/357728/

[1] The Gas Transmission System of Ukraine (GTS) is one of the most powerful and extensive networks of the trunk gas pipelines in the world. Around 50% of all natural gas from the Russian Federation was transited by the Ukrainian GTS before the RF-Ukraine war.